Innovative climate finance: A spotlight on India

Barbara Buchner, Executive Director Climate Finance, Climate Policy Initiative (CPI), uses the example of India to introduce how CPI supports economic and environmental goals by providing policy analysis and innovative financing solutions.

With strong policy and innovative finance, India is targeting a cleaner and more resilient economy that will improve livelihoods for millions of its citizens. Even before submitting its pledge as part of the Paris Agreement, India already had one of the most ambitious renewable energy targets of any country – to deploy 100 GW of solar power by 2022. This is over half of the amount of solar power deployed worldwide at the end of 2014, and 15 times India’s current solar deployment. India has also set a wind power target of 60GW by 2022, up from 25GW currently.

Then in October 2015, India pledged in its nationally determined contribution (NDC) submitted as part of the international climate negotiations that by 2030 non-fossil fuels would account for 40 per cent of its total energy generation capacity. According to officials involved in drawing up the plan, this would require almost 300 GW of total renewable energy capacity.

Meeting these targets will require a huge increase in investment. Forthcoming CPI analysis shows the amount of investment required to achieve India’s 2022 renewable energy targets is US$189 billion.

Private sector involvement

Domestic policies and national and international public finance will all play key roles in delivering India’s renewable energy targets but greatly scaling up investment from the private sector is the only way to mobilise the full amount of capital needed. This will require addressing major barriers to increasing investment. Two of the most formidable are the unattractive terms of financing for domestic investors, and the currency risks faced by domestic and international investors that are able to raise debt on international markets.

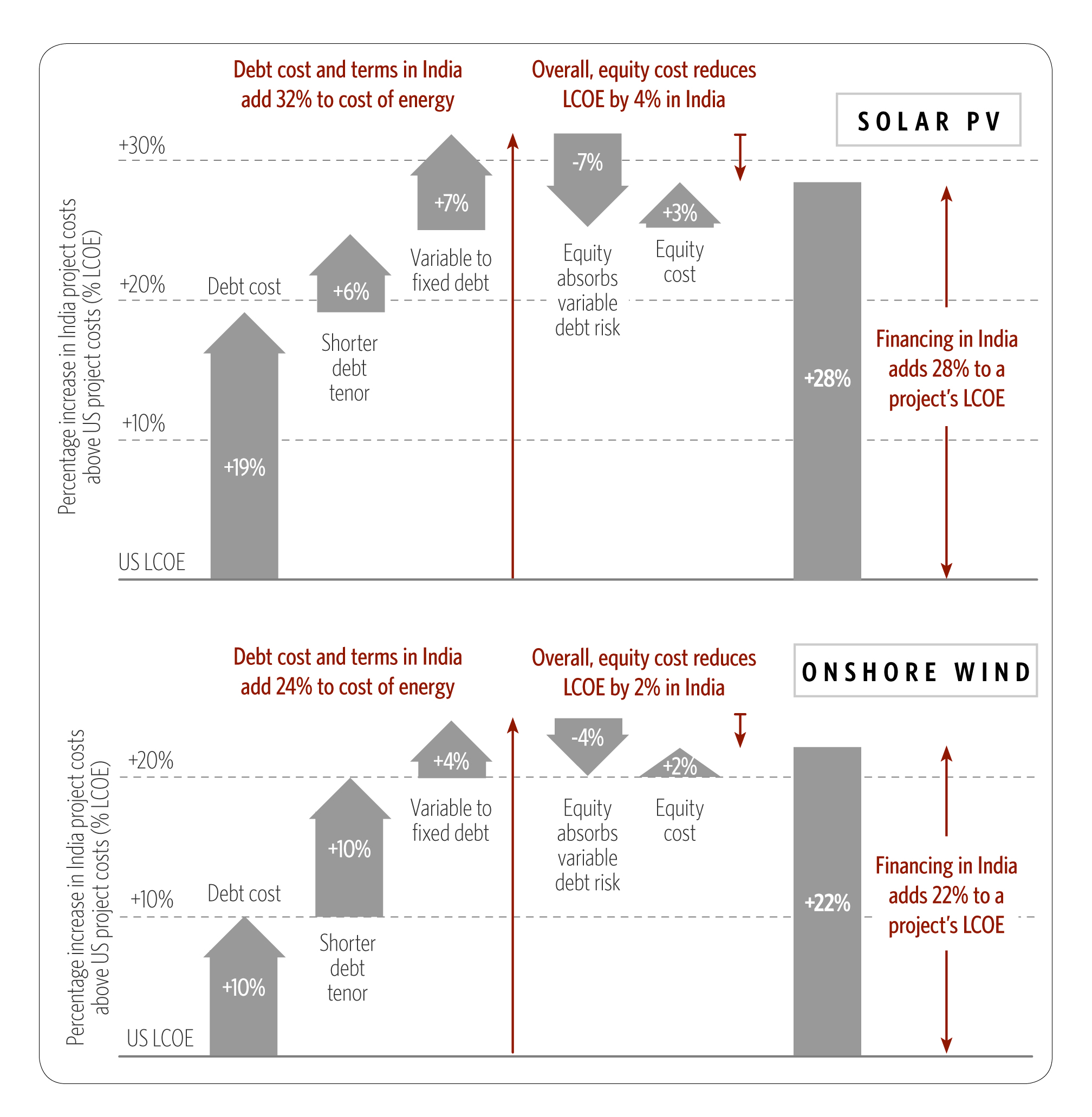

The first barrier is due to the high costs, short duration, and variable interest rates of debt available in India, which adds 30 per cent to the cost of renewable energy when compared to similar projects in developed countries.

The second, currency risk, is one of the most persistent barriers to international investment in climate action in the developing world. In countries with underdeveloped capital markets, the only viable option is to finance projects through debt in a foreign currency such as dollars or euros. Indeed, many development finance institutions only provide concessional finance in these currencies.

However, as power tariffs are often in local currency, this foreign debt creates a risk that project revenues will not be enough to pay back loans if the local currency loses value. The long time-frames involved in renewable energy investments mean changes in the value of a currency of 50 per cent or more are not uncommon. And, while the provision of low-cost, long-term debt in a foreign currency can hugely improve a project’s economics, the cost of hedging currency risk can almost entirely erode the benefits.

Together with its partners, CPI’s teams in Delhi and across the world are working on solutions to these barriers that investors face (http://climatepolicyinitiative.org/india).

For instance, our analysis shows that a federal programme to provide debt of reduced cost and extended duration could support renewable energy uptake while lowering the cost of government support by over 96 per cent. It would do so by lowering finance costs for private investors, which in turn would reduce the cost of electricity tariffs and subsequently the cost of support. Furthermore, such a programme would enable the government to recover the full cost of support over time through loan repayments, making it possible to reuse this capital to support further projects.

CPI is also working through the India Innovation Lab for Green Finance

(http://greenfinancelab.in) to support the development of a currency hedging solution to attract more investment and help reduce the cost of renewable energy. The FX Hedging Facility enables allocation of risks to suitable parties and eliminates the credit risk premium otherwise charged in a commercial currency swap. As a result, it can not only reduce the cost of currency hedging by almost 22 per cent, but also has significant leverage potential and could mobilise an estimated US$28 of foreign debt investment for every dollar of donor grant.

Financing for solar and energy efficiency

The India Lab is also developing other solutions. The Indian government’s 2022 solar targets include 40 GW of rooftop solar power by 2022. A lack of investor confidence in the sector and the small size of rooftop solar system deals mean that little debt finance is available and terms for available financing are unattractive for project developers.

The Rooftop Solar Private Sector Financing Facility addresses these barriers by structuring small projects together to bring the aggregate deal to a large enough size and sufficient credit quality to attract more investment. In addition, the Facility could demonstrate the commercial viability of the sector, enabling it to issue asset backed securities (ABS) to institutional investors, helping reduce the cost of capital and expand the investor base.

These instruments are examples of the sweet spot where CPI works, bringing together public, private and philanthropic actors to seek out and help implement novel solutions for unlocking and scaling up investment for green infrastructure, products and business practices.

The Global Innovation Lab for Climate Finance (the Lab, http://climatefinancelab.org) works in a similar way to its sister initiative in India but seeks to identify, develop, and pilot transformative climate finance instruments that can mobilise private investment in climate action in all developing countries. Indeed, Lab ideas have already attracted US$600 million in seed funding and will drive billions more in investment.

International reach

Some of these instruments are already driving investment on the ground. For instance, in 2015 the Lab selected, supported and endorsed Energy Savings Insurance (ESI), an instrument that guarantees the financial savings of energy efficiency projects in order to help small and medium-sized businesses invest in more efficient practices.

Led by the Inter-American Development Bank (IDB) with funding from the Danish government, ESI is currently operating in Mexico and Colombia. The Green Climate Fund also recently decided to finance the instrument allowing IDB to partner with the National Development Bank of El Salvador (BANDESAL) to expand the ESI programme to over 500 small and medium-sized enterprises in that country.

By unlocking investment, ESI will save these businesses money, make them more productive and deliver an estimated 560,000t CO2eq in emission reductions over a 15-year period. Ultimately, it will build a trusted and credible market for energy efficiency investments in sectors where they are not currently taking place.

If implemented in all relevant developing countries, the ESI would drive US$10-100 billion in investment and provide annual emissions reductions of 27-234 Mt CO2 by 2030. CPI hopes that this will be the first of many investment-ready Lab instruments that the Green Climate Fund and other important players choose to support.

The policy analysis and innovative financial solutions we offer are based on years of experience investigating the financial implications of acting on climate and building the networks of public, private and philanthropic actors that can make a difference.

For instance, since 2010, CPI has worked with decision-makers at international, national and local levels to help them track their flows of climate finance, for two main reasons. Firstly, to enable decision-makers to see how they are progressing against investment goals and needs and, secondly, to improve their understanding of how public policy, finance and support drive climate-relevant investment.

Tracking and assessment

CPI’s Global Landscape of Climate Finance (http://www.climatefinancelandscape.org) has become a benchmark for information about how finance is flowing from actors and sources, toward low-carbon and climate-resilient activities and we have worked with Germany, Indonesia and Côte d’Ivoire to improve their ability to track this finance.

There are many benefits to carrying out such tracking exercises. Around three quarters of total global climate finance and over 90 per cent of total private climate finance is raised and spent in the same country so, clearly, understanding how climate finance flows at the national level is key to scaling up investment.

Supporting governments to identify, tag, and track budget allocations that respond to climate change challenges enhances their ability to plan and better coordinate spending at the national and local levels and reallocate finance to areas where it will have more impact. Ultimately, this tracking of climate finance also supports the design of policies and financial instruments by helping to assess whether spending is achieving climate and growth goals cost effectively.

CPI has carried out assessment of the effectiveness of projects, investment portfolios, financial instruments and support policies. This, in turn, helps us to support development of ideas like those from the India and Global Labs, ideas that are driving investment in different countries around the world.

Our analysis in India demonstrates that meeting green growth targets is not just a question of scaling up finance. We have identified policy adjustments that can reduce the costs and maximise the benefits of the transition to a cleaner, more resilient economy. Our support for the development of new and innovative financial instruments will mobilise concrete investment in projects on the ground.

Around the world, hundreds of millions have been lifted out of poverty over the last decades. But many have been left behind and the costs for our environment threaten to undermine the progress that has been made. There is now an opportunity to mainstream clean and resilient growth models to meet climate and development goals.

CPI is committed to bringing its approach to other countries around the world to help others meet the climate and growth goals laid out in the Sustainable Development Goals and the Paris Agreement.

Read the full Climate Action 2016/17 Publication here

_-_frame_at_0m5s_400_250_80_s_c1.jpg)