Phasing out unprofitable coal plants could save US consumers $10 billion per year

The Carbon Tracker Initiative published a new report about the profitability of coal power plants in the US, suggesting that phasing out of uneconomical coal power plants could not only save $10 billion per year by 2021 for consumers, but also boost the whole country’s competitiveness.

The Carbon Tracker Initiative published a new report about the profitability of coal power plants in the US, suggesting that phasing out of uneconomical coal power plants could not only save $10 billion per year by 2021 for consumers, but also boost the whole country’s competitiveness.

The report is called “No Country for Coal Gen: Below 2°C and Regulatory Risk for US Coal Power Owners” and found that by the mid-2020s it will be cheaper to build new combines cycle gas turbines (CCGT) than continue to running 78% of the existing coal power stations.

In an expanding number of states, onshore wind and utility-scale solar PV will also provide competitive alternatives.

The financial think tank conducted the first study which looked at the economics of each US coal power plant, to equip investors with a rational closure programme and ensure their portfolios are in line with the Paris Agreement.

Carbon Tracker assessed the value of every US coal plant,- totalling in approximately 700 units, based on their operating cost and system value, comparing them with the levelised cost of a new CCGT.

Laurence Watson, Data Scientist and co-author of the report said: “Phasing out coal to meet climate targets makes economic sense”.

“Our asset-level model provides investors with a tool to align with the Paris Agreement in an economically rational way and to protect their portfolios from losses”.

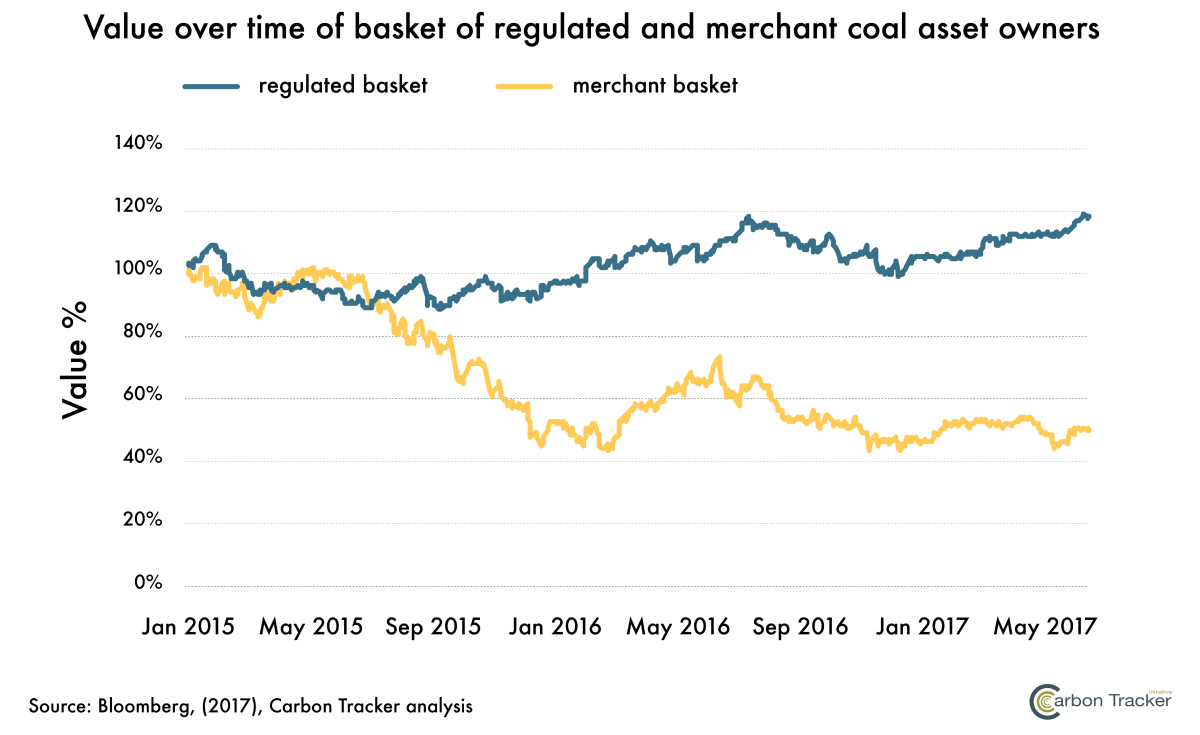

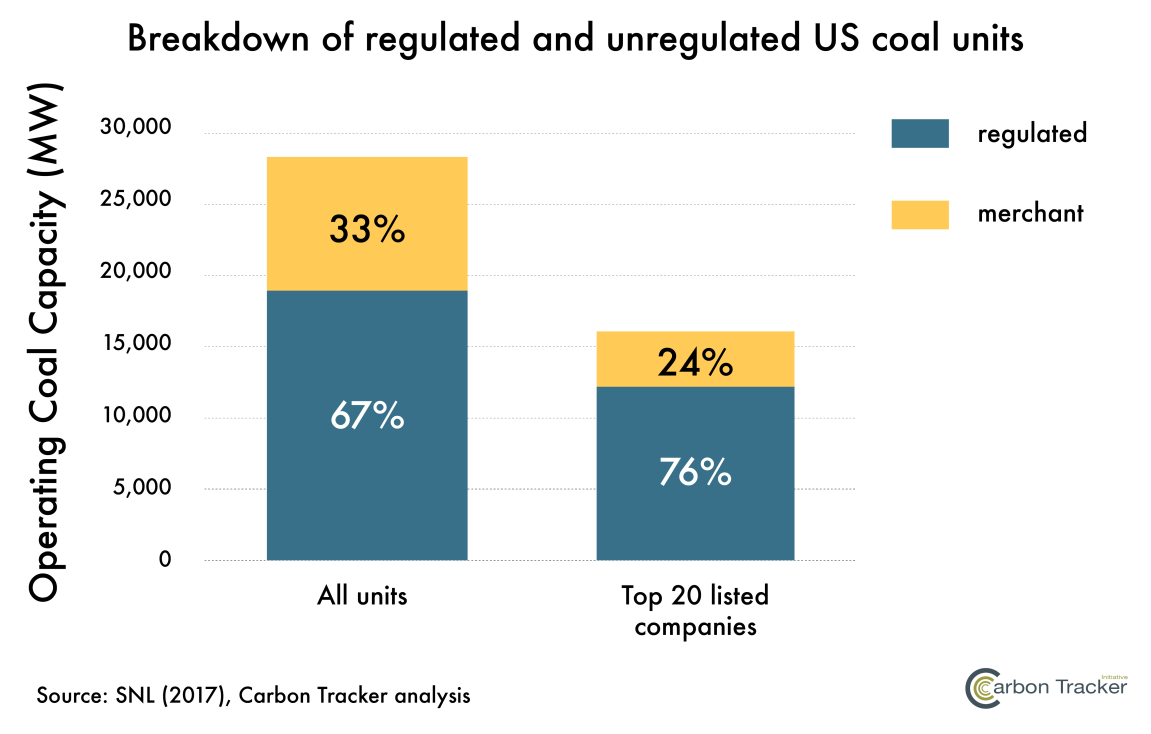

According to the report, coal owners who don’t receive government regulated prices which cover their costs, - i.e. the ‘merchant’ coal owners, have lost nearly half their value in the last two years amid fierce competition from cheap gas and renewables.

However, two thirds of coal plants are ‘regulated’ with prices approved from the Government, which means that shareholders don’t bear the true cost of the operations, but consumers do.

Matthew Gray, Senior Analyst and co-author of the report said: “Cheap gas and renewables are here to stay and will continue to undermine the economics of coal”.

The report warns that by 2021 consumers will be paying $10 billion per year to prop up more expensive existing coal power, which is equivalent to 10 percent of household energy bills in Kentucky, 9 percent in Indiana and 7 percent in Michigan and Wyoming.

Regulated coal plants will face increasing risk of interventions from regulators to protect consumers and keep the US economy competitive.

Regulatory risks amount to $185 billion, which is the difference between the artificially high book value of regulated coal plants and their actual market value.

Five of the largest listed US coal owners would see the value of their existing coal plants fall, by at least 50 percent, if the least economical ones are shut first.

Dominion will lose 60 percent, CMS 59 percent, NiSource 52 percent and DTE would lose 51 percent of their value.

However, the lost revenues could be replaced with investment in clean energy technologies if the right decisions are made at the right time.

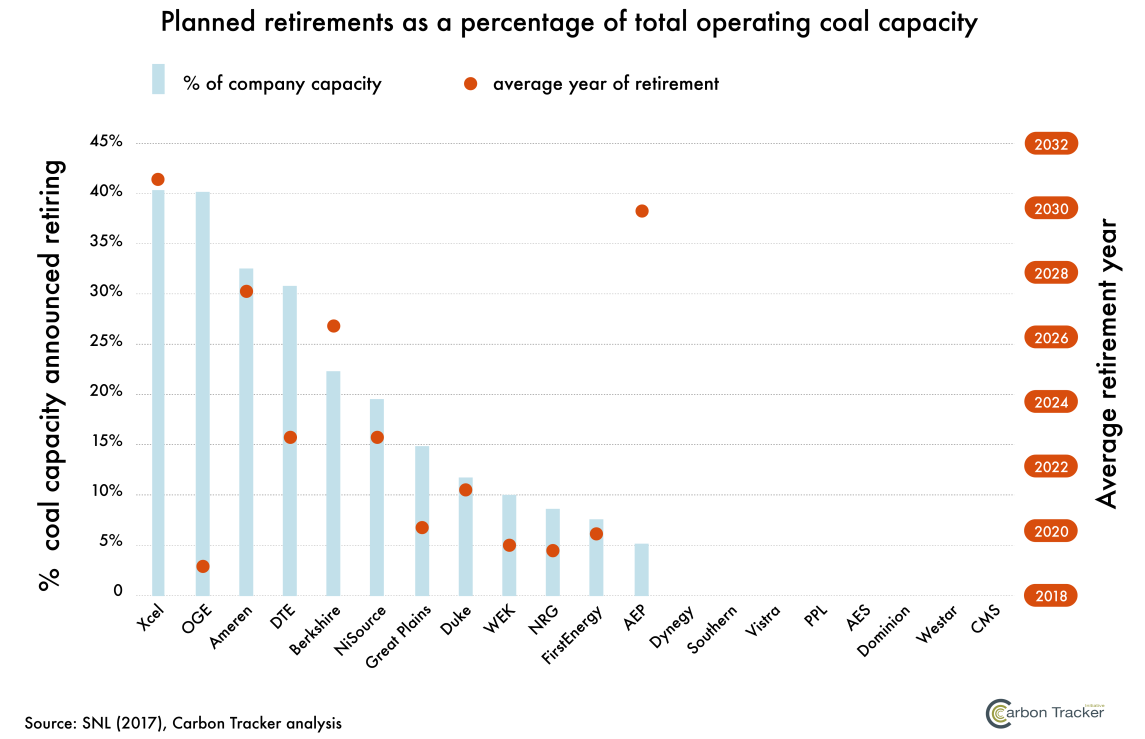

The report warns that US utilities are highly unprepared for a coal phase out, and risk making the same mistakes as European utilities.

Since 2008, Rheinisch-Westfälisches Elektrizitätswerk AG (RWE) lost 80 percent of its asset value, because of failure to understand the changes in policy, technology and business models that were transforming the energy market.

The assumptions that underpin the report were very conservative, given the current political backdrop regarding coal mining.

The financial models do not take Clean Power Plan (CPP) or carbon prices as factors, and they only consider well established environmental regulations which were drafted in 1970.

To read the full report click here.

About Carbon Tracker

The Carbon Tracker Initiative is a not-for-profit financial think tank that seeks to promote a climate-secure global energy market by aligning capital markets with climate reality. Our research to date on unburnable carbon and stranded assets has begun a new debate on how to align the financial system with the energy transition to a low carbon future. http://www.carbontracker.org