Nordic countries ushering in new era of green finance

Scandinavia has long been known for its progressive tendencies, and this is particularly true when it comes to recognising climate change’s threats and opportunities.

Scandinavia has long been known for its progressive tendencies, and this is particularly true when it comes to recognising climate change’s threats and opportunities.

New research has highlighted how the Nordic countries are also leading by example in the green finance market.

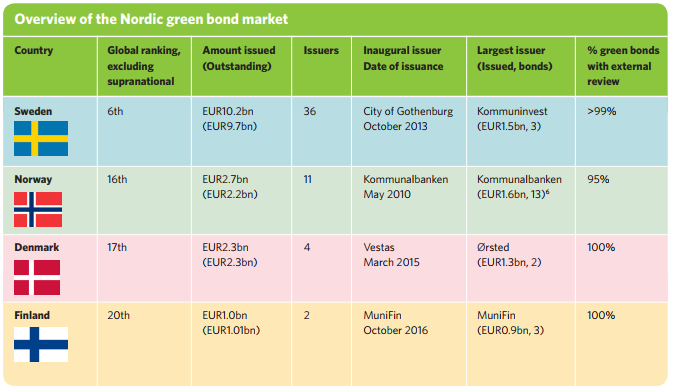

The non-profit organisation Climate Bonds Initiative has analysed progress made by Denmark, Sweden, Norway, Finland and Iceland in issuing loans which are ring-fenced to find solutions to climate change.

The Green Bond Market in the Nordics, released this week at a conference in Stockholm, shows that these countries are far ahead of the international community in the market.

While this north European region may be small in size, the data shows it punches above its weight, accounting for 6.7 percent of the entire global green bond market, and 18.5 percent in Europe as a whole.

The region’s dominance has been helped by strong climate change policies and regulations which require developers to factor in sustainability concerns.

2017 was also a particularly strong year for the Nordic region as new bond issuances reached 7.8 billion euros, more than 10 times higher than in 2013. The largest deal to date was set at 1.25 billion euros by Orsted, the Danish energy company.

Four of the five countries assessed also ranked within the global top 20 for the size and performance of their green bonds.

The money raised through these loans has been put into a range of similarly green sectors: 29 percent went into renewable energy projects, 20 percent on energy efficient buildings and a further 20 percent on low-carbon transport.

Climate Bonds Initiative CEO, Sean Kidney, commented: “Nordic nations have been at the forefront of green bond market development in Europe and worldwide, maintaining a presence in the Top 20 of issuing nations is a significant achievement.”

“Continued policy measures to promote environmental sustainability and low carbon development with support from institutional investors and stock exchanges can help maintain the momentum.”

“In combination with existing public sector green investment directions, more aggregation structures and sovereign issuance, a new phase of accelerated green finance could emerge between now and 2020.”

The report also estimates that the global market for green bonds could reach $300 billion in 2018, but that it needs to increase to at least $1 trillion by 2020 to adequately tackle climate change.

Source: Climate Bonds Initiative

Photo: GuoJunjun/CC