IEA: tax carbon emissions, don’t subsidise fossil fuels

The International Energy Agency (IEA) made headlines recently by suggesting that fossil fuels received far more global subsidies than renewable energy in 2010.

The International Energy Agency (IEA) made headlines recently by suggesting that fossil fuels received far more global subsidies than renewable energy in 2010. However, it appears that the IEA survey only included data from the countries with the largest fossil fuel subsidies, which are mainly developing countries whose economies largely depend on fossil fuel production. National Geographic’s The Great Energy Challenge also includes fossil fuel subsidy data from developed countries, bringing the total global value close to $500 billion for 2010. Bear in mind that exactly what is defined as a “subsidy” can be rather subjective, so these are just rough estimates.

It’s worth noting that this trend is changing. For example,in the USA in 2011, fossil fuel subsidies in the form of tax breaks were down to $2.5 billion while renewable energy and energy efficiency programs received $16 billion in subsidies. Even many developing countries like Iran (with the largest orange circle in Figure 1 at over $80 billion in 2010 fossil fuel subsidies) dramatically reducing their subsidizing of fossil fuels (in 2011 Iran’s subsidies were down to $20 to $30 billion).

Nevertheless, despite the movement in the right direction, global fossil fuel subsidies are still much higher than renewable energy subsidies, despite the fact that fossil fuels and associated technologies have been established for decades to centuries. Fossil fuels also receive another massive subsidy which is rarely taken into account in these types of calculations – carbon emissions.

Cost of Carbon

As we know, carbon emissions impact upon societies and economies through increasing the green house gas effect and contributing to climate change. The climate change associated with these emissions has numerous and varied effects (i.e. rising temperatures, changing rainfall patterns, extreme weather events, etc.) which impact on peoples lives.

It’s very challenging to quantify the total economic impact of these changes, but economists try to estimate the damage done by a each tonne of carbon emissions, which they have termed the “social cost of carbon” (SCC). SCC is effectively an estimate of the direct effects of carbon emissions on the economy, and takes into consideration such factors as net agricultural productivity loss, human health effects, property damages from sea level rise, and changes in ecosystem services.

SCC estimates generally vary from $5 to $68 per tonne of CO2 emitted.

Overlooked Fossil Fuel Subsidy

Global CO2 emissions from fossil fuels in 2011 totalled over 30 billion tonnes. Given the SCC range of $5 to $68 per ton of CO2, those emissions correspond to a cost of $158 billion to $2.1 trillion per year, globally – roughly $23 to $300 per person. Note that the IEA and National Geographic listed global fossil fuel subisides at $400 to $500 billion. The central estimate of the social cost of carbon emissions is roughly twice that total.

These carbon emissions may reasonably be considered a subsidy because they impose various costs on society (on agricultural productivity, property damage, human health, etc.), but since most countries don’t yet put a price on carbon emissions, these costs are not reflected in the fossil fuel market price. Rather than fossil fuel producers and consumers paying these costs, society as a whole picks up the tab. Therefore, fossil fuel prices are kept artificially low, which is generally the purpose of subsidies.

However, with all subsidies, somebody has to pick up the tab. Usually it’s taxpayers who provide the funds to implement the subsidy, but in this case it’s everyone who is adversely impacted by climate change, which is basically everybody in one form or another. For example, you pay higher food prices as climate change impacts agriculture.

It’s rather remarkable that everyone tends to overlook this immense fossil fuel subsidy, which amounts to somewhere in the ballpark of $1 trillion per year at present, globally. It’s certainly a difficult figure to quantify with a large possible range of values, but it’s also a huge cost which fossil fuel producers and consumers do not directly pay. While the market price of fossil fuels remains artificially low, we all pick up the tab to the tune of approximately $150 per person per year, on average, though those costs are unevenly distributed. However, Economics 101 says that the people who benefit from those emissions (fossil fuel consumers) should be the ones paying their cost through a price on carbon emissions.

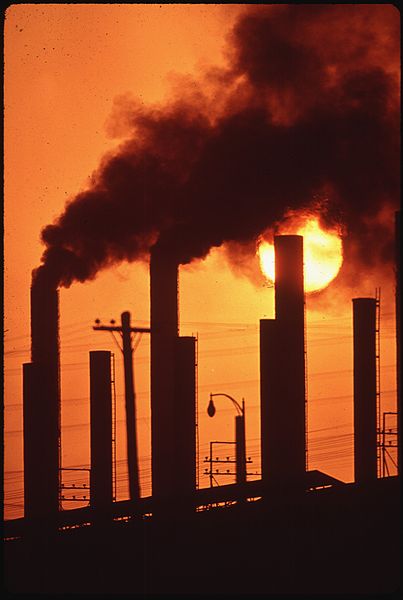

Image 01 - Birmingham, Alabama, emissions, Woodson, LeRoy,

Image 02 - U.S steel plant, Woodson, LeRoy

Image 03 - Embers, Jens Buurgaard Nielsen